Market Outlook

April 24, 2017

Market Cues

Domestic Indices

Chg (%)

(Pts)

(Close)

Indian markets are likely to open positive tracking the SGX Nifty.

BSE Sensex

(0.2)

(57)

29,365

U.S. Markets closed lower in choppy trade Friday as investors looked ahead to the

Nifty

(0.2)

(17)

9,119

French election. Wall Street also digested falling oil prices and comments from the

Mid Cap

(0.0)

(2)

14,488

Trump administration on tax reform.

Small Cap

0.3

138

15,166

The European markets ended Friday's session with mixed results. Investors were in a

Bankex

(0.6)

(6)

24,438

cautious mood due to the upcoming French election. Recent polls have suggested

that Sunday's race is too close to call amid questions about the impact of yesterday's

terrorist attack that left one French police officer dead and two other people

Global Indices

Chg (%)

(Pts)

(Close)

wounded.

Dow Jones

(0.15)

131

20,548

Indian shares erased early gains to end a tad lower on Friday ahead of this

Nasdaq

(0.11)

57

2,349

weekend's French presidential election. The benchmark BSE Sensex ended down 57

FTSE

(0.6)

4

7,115

points or 0.19% at 29,365, while the broader Nifty index dropped 17 points or

Nikkei

(1.0)

190

18,621

0.19% to 9,119.

Hang Seng

0.6

215

24,042

Shanghai Com

0.0

1

3,174

News Analysis

Sun Pharmaceutical Industries

Detailed analysis on Pg2

Advances / Declines

BSE

NSE

Advances

1,449

1,827

Investor’s Ready Reckoner

Declines

1,422

857

Key Domestic & Global Indicators

Unchanged

143

80

Stock Watch: Latest investment recommendations on 150+ stocks

Refer Pg6 onwards

Volumes (` Cr)

Top Picks

BSE

4,029

CMP

Target

Upside

Company

Sector

Rating

NSE

25,406

(`)

(`)

(%)

Blue Star

Capital Goods

Accumulate

686

760

10.8

Dewan Housing Fin. Financials

Accumulate

415

460

10.9

#Net Inflows (` Cr)

Net

Mtd

Ytd

Mahindra Lifespace

Real Estate

Buy

410

522

27.3

FII

(978)

(3,227)

40,994

Navkar Corporation Others

Buy

207

265

28.2

MFs

1,132

6,027

15,465

KEI Industries

Capital Goods

Accumulate

212

239

12.7

More Top Picks on Pg4

Top Gainers

Price (`)

Chg (%)

Key Upcoming Events

Network18

190

9.4

Previous

Consensus

Date

Region

Event Description

Reading

Expectations

SCI

84

8.5

Apr 25, 2017 Euro Zone ECB announces interest rates

0.00

Religare

209

6.8

Apr 25, 2017 US

Consumer Confidence

125.60

123.90

Gmrinfra

18

6.7

Apr 27, 2017 US

New home sales

592.00

590.00

Southbank

24

6.2

Apr 28, 2017 US

GDP QoQ (Annualised)

2.10

1.00

Apr 28, 2017 UK

GDP (YoY)

1.90

2.30

Apr 30, 2017 China

PMI Manufacturing

51.80

--

Top Losers

Price (`)

Chg (%)

More Events on Pg5

Hindzinc

274

(3.4)

Mfsl

630

(3.2)

Gsfc

120

(2.8)

Corpbank

54

(2.5)

Bankbaroda

175

(2.4)

#As on April 21, 2017

Market Outlook

April 24, 2017

News Analysis

Sun Pharmaceutical Industries

Sun Pharmaceutical Industries is reported to have received 11 observations from

the US health regulator for its Dadra unit. While inspecting the plant, the US Food

& Drug Administration found incomplete lab records at the Pharmaceutical major's

Dadra plant. These observations include failure to produce appropriate master or

control record for each batch of drugs and failure to properly investigate batches

that don't meet specifications.

Inspection of the plant by USFDA was concluded in the first week of this month.

Dadra site is the biggest unit for the company after Halol plant, for supplying drug

in the United States. The problem for the company may aggravate as its Halol

plant has already been under import alert. In FY2016, Halol contributed ~7-9% of

total sales and >15% of US sales for the company.

While currently these are only observations and will not lead to any negative

impact on the earnings of the company. Though if not rectified could let to

significant impact on US numbers. Apart from these two facilities, the company has

only one facility in Gujarat in India, which is for API and formulation both. Also,

recently the company got its Mohali facility, came out of the US import Alert.

Currently, we maintain our buy on the stock with target price of `847.

Economic and Political News

India's growth projected to bounce back in 2018: IMF

Finance Ministry approves 8.65% interest rate on EPF for 2016-17

Imposing GST on low-value imports doesn't level the playing field

Corporate News

ACC Q1 net drops 9% at `211cr

KKR sells 5.6% in Dalmia Bharat for `575cr

Narayana Hrudayalaya to acquire Panacea arm for `180cr

Market Outlook

April 24, 2017

Quarterly Bloomberg Brokers Consensus Estimate

Ultratech Cement Ltd - Apr 24, 2017

Particulars ( ` cr)

4QFY17E

4QFY16

y-o-y (%)

3QFY17

q-o-q (%)

Net sales

6,493

6,436

0.9

5,540

17.2

EBITDA

1,249

1,353

(7.7)

1,113

12.2

EBITDA margin (%)

19.2

21.0

20.1

Net profit

673

681

(1.2)

563

19.5

Wipro Ltd Consol - Apr 25, 2017

Particulars ( ` cr)

4QFY17E

4QFY16

y-o-y (%)

3QFY17

q-o-q (%)

Net sales

13,865

13,632

1.7

13,688

1.3

EBITDA

2,827

2,805

0.8

2,788

1.4

EBITDA margin (%)

20.4

20.6

20.4

Net profit

2,109

2,235

(5.6)

2,110

(0.0)

Axis Bank Ltd - Apr 25, 2017

Particulars ( ` cr)

4QFY17E

4QFY16

y-o-y (%)

3QFY17

q-o-q (%)

Net profit

803

2,154

(62.7)

580

38.6

Mahindra & Mahindra Financial Services L - Apr 25, 2017

Particulars ( ` cr)

4QFY17E

4QFY16

y-o-y (%)

3QFY17

q-o-q (%)

Net profit

338

370

(8.8)

(16)

0.0

Market Outlook

April 24, 2017

Top Picks ★★★★★

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

Strong growth in domestic business due to its leadership in

Alkem Laboratories

24,606

2,058

2,257

9.7

acute therapeutic segment. Alkem expects to launch more

products in USA, which bodes for its international business.

We expect the company would report strong profitability

Asian Granito

1,153

383

405

5.7

owing to better product mix, higher B2C sales and

amalgamation synergy..

Among the top 4 players in the consumer durables segment.

Bajaj Electricals

3,545

350

395

12.9

Improved profitability backed by turn around in E&P segment.

Strong order book lends earnings visibility.

Favourable outlook for the AC industry to augur well for

Cooling products business which is out pacing the market

Blue Star

6,556

686

760

10.8

growth. EMPPAC division's profitability to improve once

operating environment turns around..

With a focus on the low and medium income (LMI) consumer

Dewan Housing Finance

12,986

415

460

10.9

segment, the company has increased its presence in tier-II &

III cities where the growth opportunity is immense.

Strong loan growth backed by diversified loan portfolio and

Equitas Holdings

5,794

172

235

37.0

adequate CAR. ROE & ROA likely to remain decent as risk of

dilution remains low. Attractive valuations considering growth.

Economic recovery to have favourable impact on advertising

& circulation revenue growth. Further, the acquisition of a

Jagran Prakashan

6,505

196

225

14.8

radio business (Radio City) would also boost the company's

revenue growth.

High order book execution in EPC segment, rising B2C sales

KEI Industries

1,647

212

239

12.7

and higher exports to boost the revenues and profitability

Speedier execution and speedier sales, strong revenue visibilty

Mahindra Lifespace

1,803

410

522

27.3

in short-to-long run, attractive valuations

Higher growth in domestic branded sales and healthy export

Mirza International

1,096

91

107

17.5

to boost the profitability.

Massive capacity expansion along with rail advantage at ICD

Navkar Corporation

2,947

207

265

28.2

as well CFS augurs well for the company

Strong brands and distribution network would boost growth

Siyaram Silk Mills

1,594

1,700

1,872

10.1

going ahead. Stock currently trades at an inexpensive

valuation.

Market leadership in Hindi news genre and no. 2 viewership

ranking in English news genre, exit from the radio business,

TV Today Network

1,626

273

344

26.2

and anticipated growth in ad spends by corporates to benefit

the stock.

Source: Company, Angel Research

Market Outlook

April 24, 2017

Key Upcoming Events

Result Calendar

Date

Company

April 24, 2017

Rallis, UltraTech Cement, Hexaware

April 25, 2017

Wipro, Persistent

April 26, 2017

KPIT Cummins

April 27, 2017

Maruti, TVS Motor, Kotak Mah. Bank

Source: Bloomberg, Angel Research

Global economic events release calendar

Bloomberg Data

Date

Time

Country

Event Description

Unit

Period

Last Reported

Estimated

Apr 25, 2017

5:15 PM Euro Zone ECB announces interest rates

%

Apr 27

0.00

7:30 PM US

Consumer Confidence

S.A./ 1985=100

Apr

125.60

123.90

Apr 27, 2017

7:30 PM US

New home sales

Thousands

Mar

592.00

590.00

Apr 28, 2017

6:00 PM US

GDP Qoq (Annualised)

% Change

1Q A

2.10

1.00

2:00 PM UK

GDP (YoY)

% Change

1Q A

1.90

2.30

Apr 30, 2017

6:30 AM China

PMI Manufacturing

Value

Apr

51.80

May 02, 2017

2:00 PM UK

PMI Manufacturing

Value

Apr

54.20

May 03, 2017

1:25 PM Germany Unemployment change (000's)

Thousands

Apr

-30.00

11:30 PM US

FOMC rate decision

%

May 3

1.00

1.00

2:30 PM Euro Zone Euro-Zone GDP s.a. (QoQ)

% Change

1Q A

0.50

May 05, 2017

6:00 PM US

Change in Nonfarm payrolls

Thousands

Apr

98.00

6:00 PM US

Unnemployment rate

%

Apr

4.50

May 08, 2017

7:00 AM China

Consumer Price Index (YoY)

% Change

Apr

0.90

May 10, 2017

China

Exports YoY%

% Change

Apr

16.40

India

Imports YoY%

% Change

Apr

45.30

Source: Bloomberg, Angel Research

Market Outlook

April 24, 2017

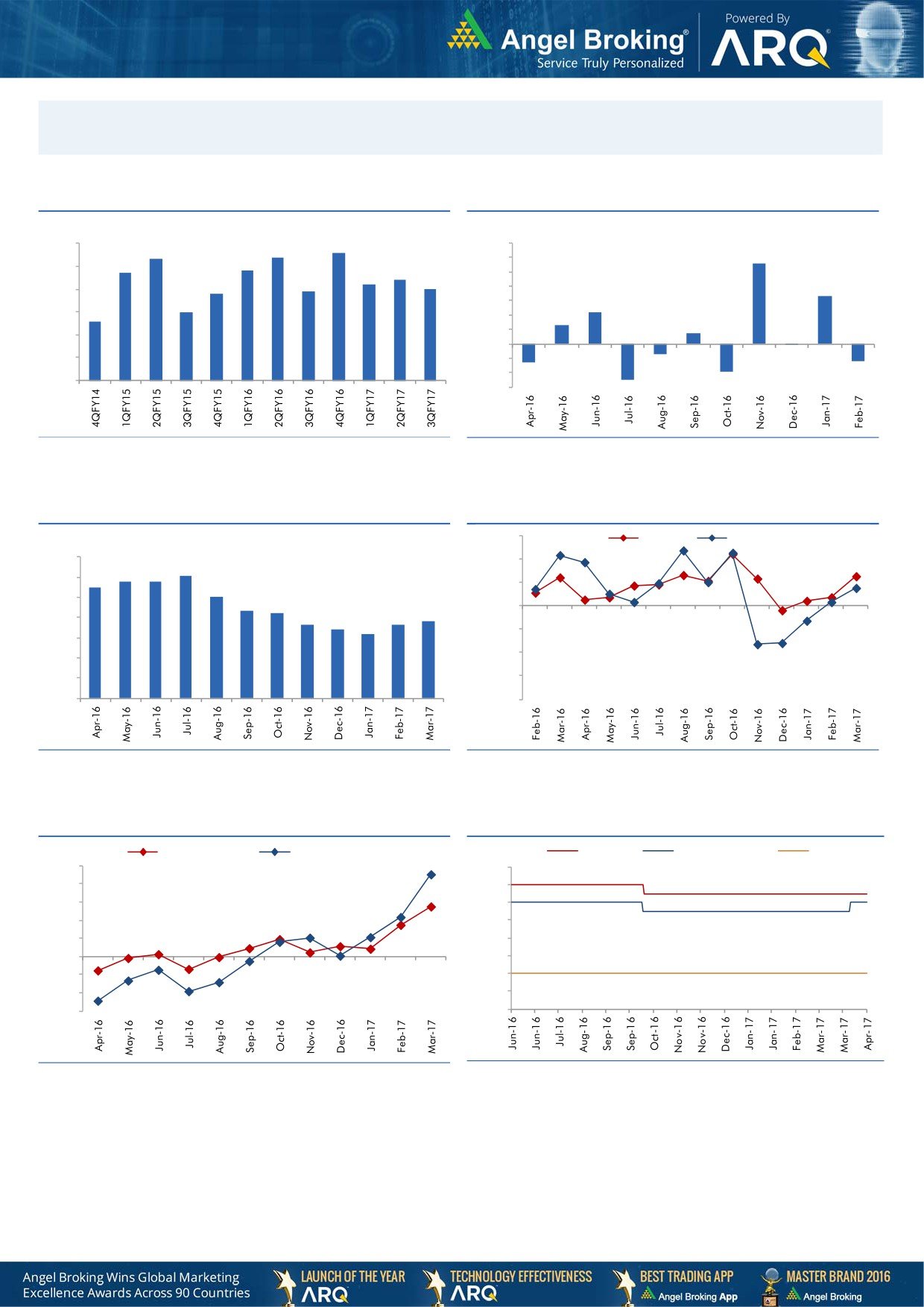

Macro watch

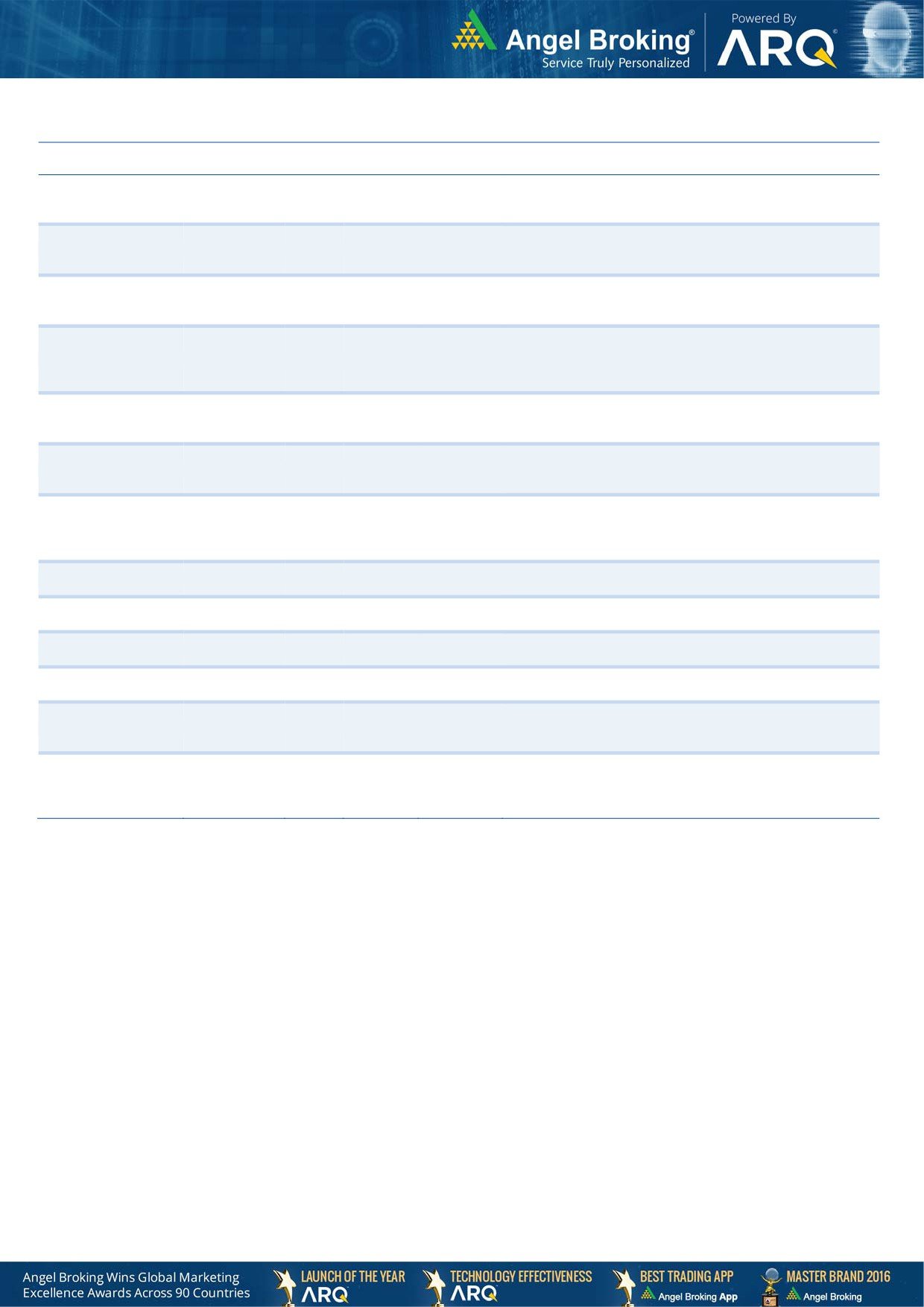

Exhibit 1: Quarterly GDP trends

Exhibit 2: IIP trends

(%)

(%)

8.6

9.0

8.3

8.4

7.0

5.6

7.7

7.8

6.0

8.0

7.4

7.2

5.0

6.9

7.0

6.8

4.0

3.3

7.0

6.0

3.0

2.2

6.0

5.6

1.3

2.0

0.7

1.0

5.0

-

4.0

(1.0)

(0.1)

(0.7)

(2.0)

(1.3)

(1.2)

3.0

(3.0)

(1.9)

(2.5)

Source: CSO, Angel Research

Source: MOSPI, Angel Research

Exhibit 3: Monthly CPI inflation trends

Exhibit 4: Manufacturing and services PMI

56.0

Mfg. PMI

Services PMI

(%)

7.0

54.0

6.1

5.8

5.8

6.0

5.5

5.1

52.0

5.0

4.3

4.2

3.8

50.0

3.6

3.7

4.0

3.4

3.2

48.0

3.0

46.0

2.0

1.0

44.0

-

42.0

Source: MOSPI, Angel Research

Source: Market, Angel Research; Note: Level above 50 indicates expansion

Exhibit 5: Exports and imports growth trends

Exhibit 6: Key policy rates

(%)

Exports yoy growth

Imports yoy growth

(%)

Repo rate

Reverse Repo rate

CRR

50.0

7.00

40.0

6.50

30.0

6.00

20.0

5.50

10.0

5.00

0.0

4.50

(10.0)

4.00

(20.0)

3.50

(30.0)

3.00

Source: Bloomberg, Angel Research

Source: RBI, Angel Research

Market Outlook

April 24, 2017

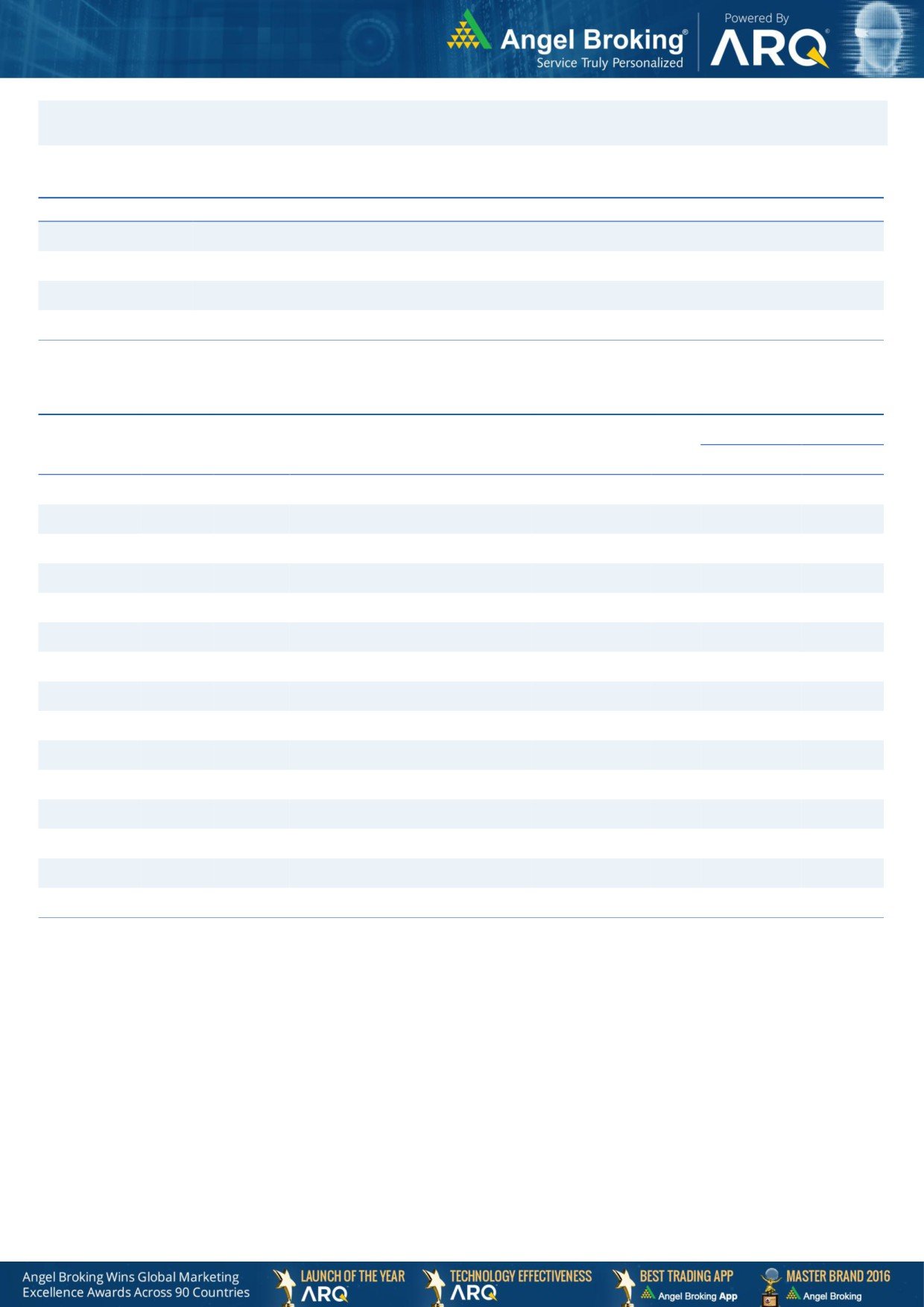

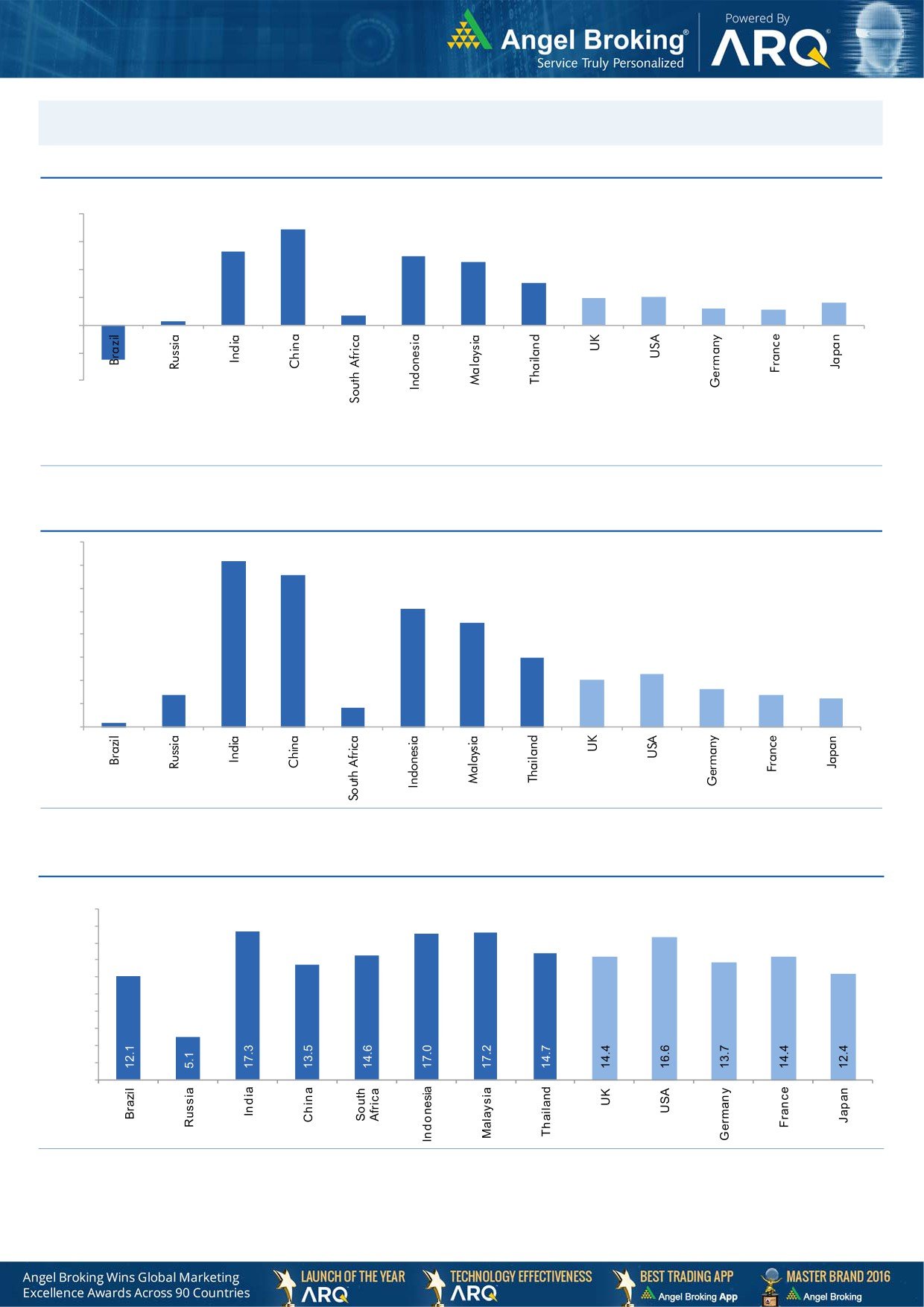

Global watch

Exhibit 1: Latest quarterly GDP Growth (%, yoy) across select developing and developed countries

(%)

8.0

6.9

0.7

5.3

6.0

4.9

4.5

4.0

3.0

0.3

1.9

2.0

1.2

1.6

1.1

2.0

-

(2.0)

(2.5)

(4.0)

Source: Bloomberg, Angel Research

Exhibit 2: 2016 GDP Growth projection by IMF (%, yoy) across select developing and developed countries

(%)

7.2

7.0

6.6

6.0

5.1

5.0

4.5

4.0

3.0

3.0

2.3

2.0

1.4

1.6

2.0

1.4

1.2

0.2

0.8

1.0

-

Source: IMF, Angel Research

Exhibit 3: One year forward P-E ratio across select developing and developed countries

(x)

20.0

18.0

16.0

14.0

12.0

10.0

8.0

6.0

4.0

2.0

-

Source: IMF, Angel Research

Market Outlook

April 24, 2017

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.